The Background: Fuel Duty and Declining Revenues

For decades, the UK government has relied heavily on fuel duty—a tax levied on petrol and diesel—alongside Vehicle Excise Duty (VED) as a primary source of revenue from motorists. Fuel duty alone has generated billions annually, used to fund public services, infrastructure, and specifically the upkeep of road networks.

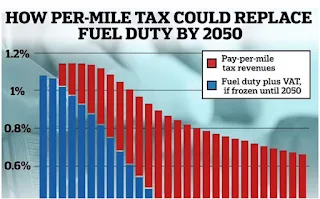

However, as more drivers shift to electric vehicles (EVs), which bypass the need for fossil fuels, this revenue stream is shrinking.

In anticipation of the ban on new petrol and diesel car sales by 2030, the government faces a looming budget shortfall. Without a replacement for the lost income from fuel duty, funding for critical infrastructure could be at risk, particularly with the growing need for investment in roads and EV-related facilities.

What is the 1p per Mile Tax Proposal?

The 1p per mile tax proposal suggests that motorists, regardless of whether they drive a petrol, diesel, hybrid, or fully electric vehicle, would pay a fixed rate of one penny for each mile they travel.

This system would provide a consistent revenue stream based on road usage rather than fuel consumption, making it a fairer approach as EV adoption continues to rise.

This approach is also considered more equitable since it accounts for individual road usage rather than penalizing drivers based on the type of fuel they use. By paying per mile, all motorists contribute proportionally to the wear and tear on the nation’s roads.

Key Features of the Proposal

1. Uniform Rate: The tax rate is set at a flat 1p per mile, applied equally across all vehicles. This simplicity is intended to make it straightforward for drivers to understand and calculate their costs.

2. Fairness and Sustainability: This tax model ensures that every motorist contributes to road upkeep in proportion to their actual use, aligning with the “user pays” principle. Since all types of vehicles cause wear and tear on roads, this system would distribute the maintenance burden more evenly.

3. Encouragement of Efficient Travel: By charging based on miles driven, the tax could incentivize drivers to be more conscious of the miles they travel, potentially encouraging a shift toward public transport, carpooling, or fewer short trips by car.

4. Administrative Considerations: Implementing a mileage-based tax could be complex. Options for tracking mileage include GPS systems, onboard devices, or annual mileage declarations. Each has privacy, cost, and enforcement implications that would need careful management.

Potential Pros of the 1p per Mile Tax

• Fairness Across Fuel Types: As EVs become more widespread, this tax ensures that all drivers contribute to the road system, regardless of fuel type.

• Revenue Stability: It provides a more reliable revenue stream that adjusts to real-time road usage, unlike fuel duty, which is declining as EV adoption increases.

• Encouragement of Sustainable Practices: A pay-per-mile model could help reduce unnecessary trips, reduce traffic, and promote alternative transport methods.

Concerns and Criticisms

• Privacy Issues: Tracking miles may require GPS or data-sharing systems, raising privacy concerns among motorists.

• Rural Drivers: Motorists in rural areas may face a higher tax burden since they often drive longer distances for basic needs.

• Implementation Costs: Setting up a per-mile tax system could require significant investment, especially if it relies on new technology or infrastructure to track mileage accurately.

Looking Forward: A Model for Future Roads?

The 1p per mile tax proposal represents a possible shift in how the UK funds road infrastructure as the automotive industry transitions to electric. If successful, it could provide a template for other countries facing similar challenges in replacing fuel-duty revenue with fairer, usage-based systems.

However, it will require careful implementation, with attention to privacy, rural drivers, and potential unforeseen consequences.

The 1p per mile tax may herald a new era of road management and funding, setting the UK on a sustainable path for maintaining roadways and encouraging efficient travel in a world moving toward cleaner energy.

Attached is a news article regarding the 1p per mile tax

https://www.gbnews.com/lifestyle/cars/pay-per-mile-car-tax-changes-replace-fuel-duty-budget-reaction

Article written and configured by Christopher Stanley

<!-- Google tag (gtag.js) --> <script async src="https://www.googletagmanager.com/gtag/js?id=G-XDGJVZXVQ4"></script> <script> window.dataLayer = window.dataLayer || []; function gtag(){dataLayer.push(arguments);} gtag('js', new Date()); gtag('config', 'G-XDGJVZXVQ4'); </script>

<script src="https://cdn-eu.pagesense.io/js/smilebandltd/45e5a7e3cddc4e92ba91fba8dc

No comments:

Post a Comment